Confused by the Homebuying Process? Worried About Overpaying or Making Mistakes?

Get expert guidance, avoid costly mistakes, and receive up to $1000 in Incentives to help you Buy a Home with confidence!

Your Course Overview

Your Course Overview

The Course Curriculum

Earn incentives by learning all about the homebuying process.

Module 1: Transaction Basics

Buying a home is a team effort, and understanding who’s involved can help you navigate the process with confidence. In this module, you’ll learn the fundamentals of a real estate transaction—from start to finish. Discover the key players, their roles, and areas of expertise, so you know exactly who to turn to at each stage. We’ll also break down how these professionals are compensated and who they’re accountable to, giving you full transparency into the homebuying process.

Module 2: Down Payment Assistance

Think you need 20% down to buy a home? Think again! In this module, you’ll explore various down payment assistance programs designed to reduce or even eliminate your upfront costs. Learn how to navigate local and national programs, understand their benefits and trade-offs, and determine the best financial strategy for your home purchase. With the right resources, homeownership may be more affordable than you think!

Module 3: Mortgage Process

Your mortgage journey runs alongside the homebuying process, but it requires your active participation every step of the way. In this module, we take a deep dive into how mortgages work, the key milestones in the loan process, and when critical actions should take place. Understanding the timing and sequence of events can help you avoid costly delays and mistakes. Plus, we’ll highlight common pitfalls borrowers face—and how you can steer clear of them to keep your home purchase on track!

Module 4: Timelines & Expectations

Homebuying is a process, not an event. This section prepares you for what to expect at each stage and how to stay on track.

While you have rights as a buyer, lenders and professionals are also assessing your ability to complete the purchase and meet loan commitments. Patience and preparation are key to a smooth closing.

Module 5: Completion Certificate

Congratulations on completing The Road to Homeownership!🎉

Your Completion Certificate unlocks exclusive financial perks. Submit it to your loan officer when your home purchase contract is submitted to claim your savings.

In just one hour (1 hour), you’re now one step closer to owning your dream home—well done! 🏡

Up to $1000 in Homebuying Credits - Yours Today for $0 - Register Now!

When You Enroll Today, You Also Receive

$300 Appraisal Credit

Save on one of the key upfront costs of buying a home! We will credit up to 50% of your prepaid appraisal costs, up to $300, at closing.

$400 in Title Discounts

Title services are essential in a real estate transaction. Save up to $400 on title services when using participating title companies.

$300 Home Warranty Credit

Concerned about unexpected ownership expenses? Get instant protection for unexpected repairs with a comprehensive home warranty.

Everything you need to confidently buy a home.

Over $1000 in incentives - Yours Today at $0 Cost.

Hear From Real People With Real Results

This course was a game-changer!

"I went in feeling overwhelmed but left with a clear understanding of the process. Plus, the appraisal credit and title discount saved me hundreds at closing!" – Jasmine R.

We thought we needed 20% down.

"Thanks to this course, we found a low down payment program that made homeownership possible much sooner than we expected." – Marcus & Cree Baker

The home warranty alone was worth it!

"We had a big repair right after moving in, and the warranty covered it. Learning what to expect in the buying process also helped us avoid major mistakes." - Jeff & Leona T.

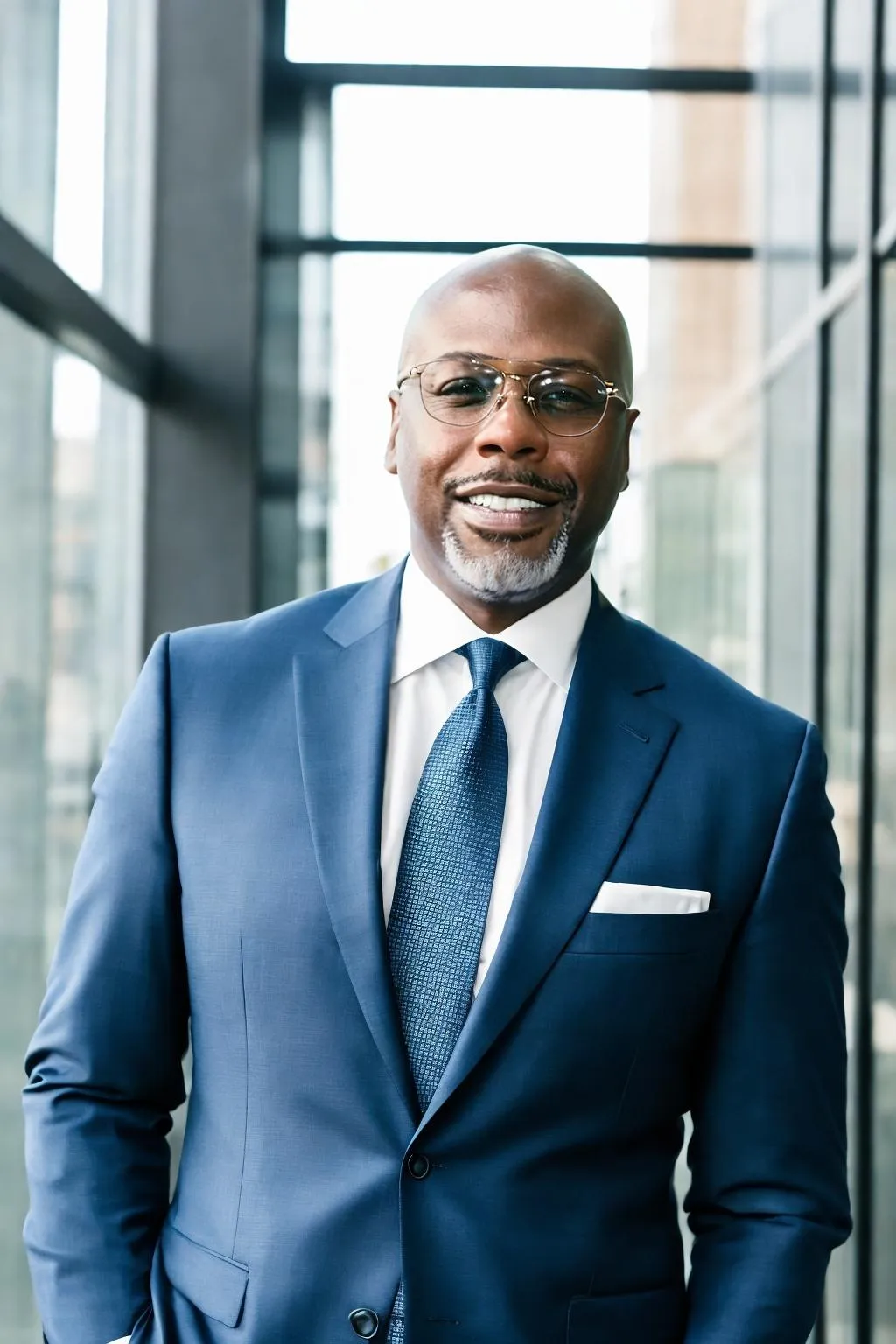

About Your Course Instructor

Why Should They Listen To You?

A skilled mortgage professional is both knowledgeable and adept in identifying clients’ needs. Growing up in a working-class Baltimore community taught Kwe Parker the importance of hard work, integrity and helped formulate the compassion he uses to guide people through financial transactions. This may explain why Kwe

views his mortgage banking career as an opportunity to help people fulfil their dreams of homeownership and show them ways to leverage real estate to build wealth.

Kwe Parker has over 25 years of real estate finance

experience and he is a graduate of Marylhurst University, one of the nation’s only real estate finance curriculums. Whether home improvement lending, FHA rate reductions or luxury home construction mortgages, Kwe has a rare diversity of experiences to help clients with simple and complicated mortgage needs. Since 2003, he has originated and managed over $1 billion dollars in mortgage originations nationwide.

He released this book to answer the many questions that

potential home buyers frequently have when contemplating buying a home.

Professional Memberships & Affiliations

1. Mortgage Bankers Association

2. National Association of Real Estate Brokers

3. National Association of REALTORS

HERE'S WHAT YOU GET:

The Offer Headline Ipsum

$300 Appraisal Credit

Up to $400 in Title Discounts

$300 Home Warranty Credit

Top Team of Professionals working in your corner!

Earn incentives By Educating Yourself

$0 Cost to You!

"Better than the paid class."

"I got more value out of one hour of this class than I did sitting in a 3 hour local homebuyer's education course. Plus, I didn't have to leave my house or kill my Saturday."

Legal Disclaimer: Equity One Lending is a Texas dba of OM Mortgage, LLC. Loans are originated as OM Mortgage, LLC in all other states. Company NMLS: 1972491.